Rising Yields, Rising Risks

Introduction

Time to Reassess Wall Street's Role. With U.S. Treasury yields rising, a ballooning national debt, and all three credit rating agencies downgrading U.S. debt, confidence in the traditional “risk-free” markets are cracking. As JPMorgan CEO Jamie Dimon warns, “The system is breaking.”

This month, we explore what the breakdown of the system means for investors, how Treasury volatility is impacting Main Street and the stock market, and why First Trust Deeds may be the better place to park capital in 2025. In a world where Wall Street feels increasingly speculative and unstable, investing in Main Street isn’t just safer—it’s smarter.

Treasury Yields: A New Reality for the 'Risk-Free' Rate

In normal times, U.S. Treasuries act as the bedrock of the financial system. When investors buy Treasuries, they're lending to the U.S. government—a borrower that has never defaulted on its debt. That stability anchors interest rates across nearly all other asset classes.

But in 2025, that anchor is dragging.

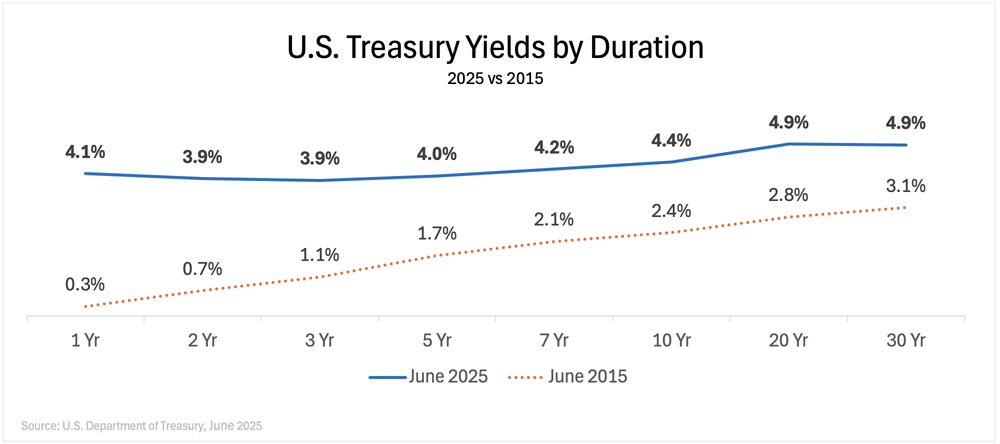

After a sweeping credit downgrade in May, Treasury yields have remained elevated. As of June 11:

• The 10-year Treasury yield sits at 4.4%

• The 1-year Treasury yield is 4.1%, creating a relatively flat yield curve

• The Federal Funds Rate remains at 5.25% (unchanged since late 2024)

Refer to chart “U.S. Treasury Yields by Duration” for a visual representation of today’s flat Treasury yield curve compared to 2015’s.

Historically, long-term rates (like the 10-year) tend to run about 1.0% higher than short-term rates. A flat curve suggests bond markets are unsure about future growth. Or worse: that they expect lower rates ahead due to a potential recession.

Jamie Dimon’s remarks echo this uncertainty. He cautioned that bond markets are sending signals that “can no longer be ignored,” highlighting the rising disconnect between asset valuations and economic fundamentals.

On June 18, Federal Reserve Chair Jerome Powell announced that the Federal Reserve would keep interest rates steady at 5.25%, citing a cautious approach amid ongoing uncertainty. Powell explained that while inflation had eased somewhat, the recent volatility in the bond markets and elevated long-term yields were already exerting a tightening effect on financial conditions. He noted that raising rates further risked unnecessarily slowing growth, while cutting rates too soon could reignite inflationary pressures. “We’re in a holding pattern until we have greater clarity,” Powell stated, reinforcing the Federal Reserve’s commitment to balancing inflation control with economic stability.

America’s Debt Burden: The Elephant in the Bond Market

Why are yields holding steady at higher levels? One major reason: debt.

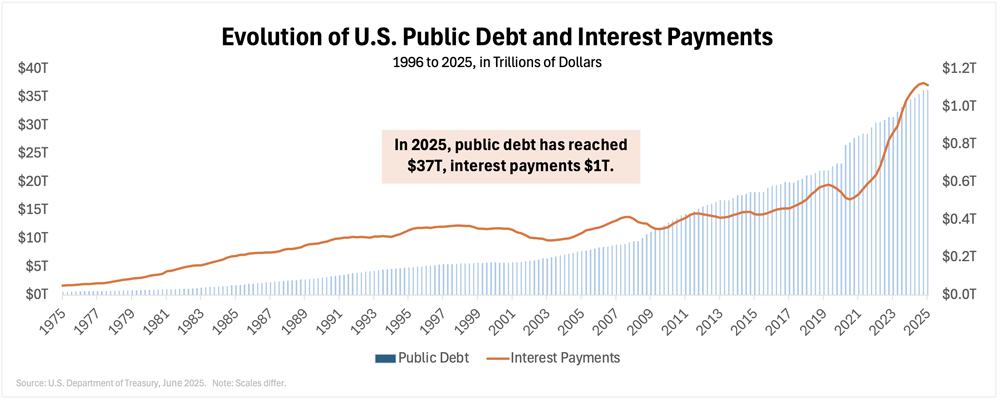

• The U.S. national debt stands at $36.9 trillion, with annual interest payments reaching $1 trillion (U.S. National Debt Clock, June 2025).

• In May 2025, Moody’s downgraded U.S. sovereign credit from AA+ to AA, citing unsustainable fiscal deficits and prolonged political gridlock.

• With this move, all three major rating agencies—Moody’s, S&P, and Fitch—have now downgraded U.S. government debt since 2011, signaling broad-based concern over the country’s long-term fiscal trajectory.

Refer to the chart “Evolution of U.S. Public Debt and Interest Payments” for a visualization of public debt and associated interest payments from 1975 to 2025.

As bond prices fall and yields rise—or remain elevated—the cost of capital across the economy climbs with them. This means higher borrowing costs for businesses, municipalities, and most importantly—consumers.

Dimon reinforced this point by noting that “the bond market is starting to reflect a world where U.S. debt is no longer a free ride.”

Ripple Effects on Main Street

For everyday Americans, elevated Treasury yields are more than a headline. They're reshaping life on Main Street:

• Mortgage Rates: The average 30-year fixed mortgage rate climbed to 6.9% in May, up from 5.8% at the beginning of the year (Freddie Mac). For a $400,000 home loan, that adds over $260/month in interest.

• Real Estate Impact: In 2024, U.S. existing-home sales totaled 4.06 million—a 0.7% decline from 2023, marking the weakest year for home sales since 1995 (National Association of Realtors, May 2025). The decline continues in 2025, with April year-over-year data showing a further 2% drop (NAR, April 2025).

• Business Lending: Small businesses report rising difficulty securing loans as banks tighten credit standards (Federal Reserve SLOOS Survey, Q2 2025).

The signal is clear: the ripple effects of Treasury market volatility are pricing Main Street out of credit. The cost of capital is simply too high for ordinary Americans to absorb without cutting spending, delaying homeownership, or shelving business expansion plans.

Jamie Dimon described this environment as one where “credit tightens from the outside in”—a condition he believes could hurt local economies more than Wall Street portfolios.

Impact on the Stock Market: Volatility and Valuation Risk

Rising Treasury yields don’t just affect bonds and loans—they also pressure equities.

• Higher yields reduce the present value of future corporate earnings, pressuring growth stock valuations.

• Despite a volatile May, the S&P 500 rose from 5,604 on May 1 to 5,911 on May 30, a gain of 5.5%, reflecting temporary optimism. However, this gain masks underlying fragility.

• Tech stocks were mixed: while megacaps such as Microsoft and Nvidia held gains, more speculative growth names like Palantir Technologies and the ARK Innovation ETF experienced heightened volatility and selective selloffs.

Jamie Dimon has cautioned that equity markets remain "divorced from fiscal reality." If bond yields continue to rise—or stay high—the equity risk premium narrows, meaning investors are taking more risk for less reward.

For long-term investors, this introduces major portfolio allocation questions: is the stock market still the best home for capital in a high-yield, high-volatility environment?

What It Means for Investors: Yield Without the Chaos

So what does this mean for investors seeking yield, stability, and preservation of capital?

Traditionally, Treasuries have been the answer. But today, they expose portfolios to long-duration risk, inflation erosion, and headline-driven volatility.

Enter: First Trust Deeds.

• Stable Income: Our First Trust Deeds currently offer returns starting at 10%+—more than double that of your average Treasuries.

• Inflation Protection: With collateral in real estate and inflation-adjusted rents, trust deeds are keeping pace with rising costs, unlike bond yields.

• Wealth Preservation: Rather than swing with rate speculation or political headlines, trust deeds offer fixed, contractual payments backed by physical property.

Dimon, who has warned that systemic risks are accumulating across traditional markets, might agrees that now is the time to revisit alternative fixed-income strategies.

In short, investors are no longer making money in traditional bond markets. But they are getting paid to lend to real America: Main Street borrowers creating real value, secured by real assets.

And here’s the upside—unlike Wall Street, which thrives on volatility and speculation, investing in Main Street offers something different: stability, transparency, and a sense of real contribution to local economic resilience.

Final Take: It’s Time to Step Off the Roller Coaster

As yields rise and volatility follows, we must ask: are the old assumptions still valid? Does Wall Street deserve your trust when Main Street is footing the bill?

First Trust Deeds offer a compelling answer. They deliver:

• Predictable steady cash flow

• Security of hard-asset collateral

• Alignment with the future of American economic policy

Jamie Dimon put it best when he said, “The system is breaking.” That doesn’t mean it’s too late—it means it’s time to adapt.

Let’s Talk

Safeguard has 20+ years of experience helping investors navigate changing markets. Call us at 877-280-5771 to learn how First Trust Deeds can help you invest in America’s real economy—today.

The opportunity is no longer just on Wall Street. It’s right outside your front door.