Main Street's Turn:Rebalancing America's Economy

Introduction

"For the last four decades, Wall Street has grown wealthier than ever before, and it can continue to grow and do well. But for the next four years, it's Main Street's turn."

That powerful statement from U.S. Treasury Secretary Scott Bessent marks a new chapter in the American economy. After years of asset-driven gains, stock buybacks, and soaring executive pay, the Trump administration has placed its bets firmly on small businesses, workers, and local growth.

In this edition of our newsletter, we explore what happened to Main Street over the past 40 years, the administration's new strategy for economic revival, and what this shift means for you as an investor seeking stability and real opportunity.

This transformation gutted small towns, widened income inequality, and left Main Street increasingly disconnected from the prosperity seen in financial centers. It highlights the urgent need to rebalance economic growth and create a more inclusive path forward, where Main Street has the opportunity to share in the nation's prosperity once again.

The Collapse of American Manufacturing

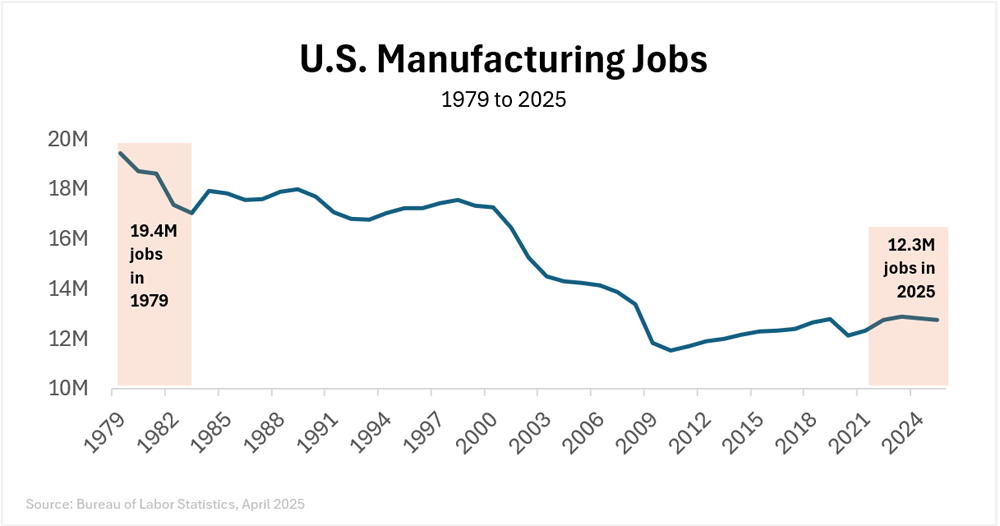

One of the most significant factors behind Main Street's struggles has been the decline in U.S. manufacturing employment:

• Job Losses: Manufacturing employment fell from a peak of 19.4 million in 1979 to just 12.3 million in 2025 (Bureau of Labor Statistics, April 2025), a 37% decline despite the overall U.S. population increasing by over 100 million people. Refer to the chart “U.S. Manufacturing Jobs” for a detailed evolution of job losses.

• Globalization Impact: Cheaper labor costs overseas led to widespread offshoring, particularly to China, Mexico, and Southeast Asia.

• Policy Decisions: Trade deals like NAFTA, signed in 1994, and China’s admission to the World Trade Organization (WTO) in 2001 accelerated the outsourcing of American manufacturing jobs.

• Technological Advances: Automation and technology further reduced the number of manufacturing jobs, favoring highly skilled workers over traditional labor.

Four Decades of Wall Street Dominance

Over the past 40 years, the gap between Wall Street and Main Street has widened dramatically, reshaping the American economy:

• CEO vs. Worker Pay: In 1978, CEOs earned 31 times more than the average worker. By 2023, that ratio had ballooned to over 344-to-1 (Economic Policy Institute, 2023). Refer to the chart "CEO-to-Worker Compensation“ for a detailed evolution of the compensation ratio.

• Stagnant Wages: Real middle-income wages have only increased about 17% since 1979, while wages of the top 10% of earners have increased 46% (Economic Policy Institute, 2023).

• Stock Ownership: In 2023, the top 10% of U.S. households owned 89% of all corporate equities and mutual fund shares, up from 70% in 1989 (Federal Reserve Survey of Consumer Finances). Meanwhile, the bottom 50% of households held less than 1% of all stocks.

The erosion of manufacturing hollowed out small towns and mid-sized cities across the U.S., contributing to wage stagnation, economic blight, and a deep sense of dislocation for millions of workers and families. Reversing this trend is key to rebuilding America's middle class and ensuring that prosperity reaches all corners of the country.

The New Agenda: A Main Street Revival

In 2025, the Trump administration unveiled an aggressive plan to rebalance the economy:

• Tariffs: Designed to bring back domestic manufacturing and reduce dependence on global supply chains. The effective tariff rate is projected to rise from 2.5% to 22% (Fitch Ratings, April 2025).

• Tax Policy: The administration has proposed no tax on tips, overtime pay, or Social Security income, along with extending Trump-era tax cuts and restoring 100% depreciation for small business investment (CNBC, April 9, 2025).

• Lower Rates: Since the 2024 election, mortgage rates have fallen significantly. The 30-year fixed mortgage rate dropped from 7.2% in October 2024 to 5.8% by April 2025 (Freddie Mac). Lower interest rates make homeownership and borrowing more accessible for everyday Americans.

• Deregulation: Aimed at lowering administrative costs that previous regulations added to housing, energy, and healthcare. Treasury Secretary Bessent noted that reducing regulatory burdens could save households several thousand dollars annually.

The administration’s focus is on empowering the real economy, building wealth from the bottom up rather than the top down. By redirecting growth to the heart of America, the goal is to ignite a new cycle of investment, entrepreneurship, and opportunity where it is needed most.

Why Main Street Growth Means Opportunities for Investors

The rebalancing toward Main Street is already creating measurable shifts:

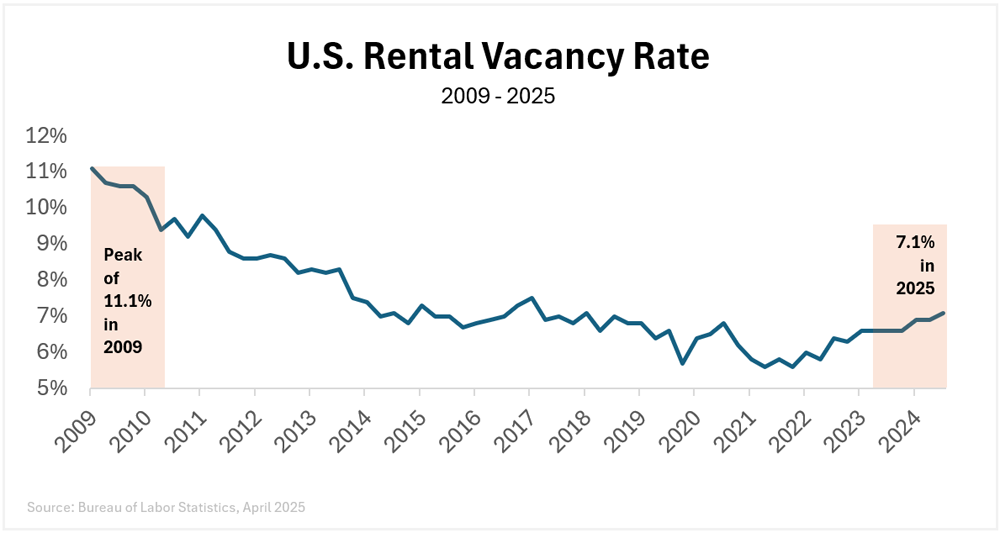

• Rental and Housing Demand: Demand for housing is surging, especially in high-migration states like Texas, Florida, and Arizona. National vacancy rates of around 7.1% remained stable and far below the peak of 11.1% following the Financial Crisis of 2008 (U.S. Census Bureau, Q1 2025). Meanwhile, rental prices have risen 6.2% year-over-year nationally (Zillow Research, March 2025). Refer to the chart “U.S. Rental Vacancy Rate” for more details.

• Small Business Lending Gap: As large banks tighten credit standards, private lenders are stepping in to fill financing needs for local developers and entrepreneurs (Senior Loan Officer Opinion Survey, March 2025).

• Trust Deed Advantage: First Trust Deeds offer fixed income backed by tangible real estate. They sidestep the volatility of public equities and continue to deliver attractive returns in the range of 10.5%+

With Main Street rebuilding, trust deeds are uniquely positioned to benefit from localized economic growth and increased housing demand. As the economy transitions to support small businesses and local communities, real estate-backed investments provide a compelling way to participate in America’s resurgence while enjoying stable, predictable returns.

What Does It Mean For Investors?

Main Street’s revival is more than rhetoric. It’s a real, measurable trend backed by policy and economic fundamentals.

For investors, the implications are clear:

• Wall Street’s volatility remains elevated amid geopolitical and policy uncertainty.

• Inflation continues to erode the value of cash and traditional bonds.

• Real estate-backed income—through First Trust Deeds—offers a tangible hedge against inflation and market instability.

First Trust Deeds provide:

• Stable, income-driven investments

• Security through real property collateral

• Reliable cash flow in an uncertain economic environment

• Alignment with America’s Main Street-focused future

At Safeguard, we see this as a once-in-a-generation opportunity. By investing in the heartbeat of America’s economy—Main Street—you position yourself for resilience, growth, and consistent returns. It's an opportunity to move beyond speculation and toward real, lasting wealth creation.

Let’s Talk

Safeguard has 20+ years of experience helping investors navigate changing markets. Call us at 877-280-5771 to learn how First Trust Deeds can help you invest in America’s real economy—today.

The opportunity is no longer just on Wall Street. It’s right outside your front door.

Call 877-280-5771 to learn more.

With 20+ years of experience navigating market cycles, our team at Safeguard is here to help. If stability matters to you, let’s talk.