The Fed Can Cut Rates, But It Can’t Build Homes

Introduction

In September, the Federal Reserve (Fed) announced its first rate cut since 2023, trimming the federal funds rate by 25 basis points. Wall Street cheered, mortgage lenders rushed to advertise slightly lower rates, and investors welcomed a breath of optimism after months of volatility.

But for Main Street, the rate cut is little more than a headline. Lower borrowing costs may help at the margin, but the real problem in the U.S. housing market isn’t interest rates—it’s supply. America faces a structural shortage of millions of homes, and no Fed decision can change that overnight.

We’ll explore what the housing shortage means for Main Street, why the gap persists, and how this imbalance creates opportunities for investors in First Trust Deeds.

The Fed’s Move: Cheaper Money, Same Problem

The Fed’s September 2025 decision brought the federal funds rate down to 4.25%, the first cut since December 2024. Mortgage rates responded modestly: the average 30-year fixed rate slipped from 6.6% in August to 6.3% in late September, according to Freddie Mac.

That’s welcome relief for prospective buyers. On a $400,000 loan, the drop shaves off about $75 per month in payments. But, affordability remains far out of reach for millions. Median home prices have risen nearly 60% since 2019, while incomes lag behind, according to Harvard’s Joint Center for Housing Studies. And critically, even buyers who can afford today’s payments face a bigger obstacle: there simply aren’t enough homes to buy.

America’s Housing Shortage: Millions of Homes Missing

By most estimates, the U.S. is short between 3.8 million and 7.1 million housing units, depending on methodology, according to Brookings, 2023 and the National Low Income Housing Commission. Zillow recently placed the gap at 4.7 million homes as of mid-2025—and despite elevated construction, the deficit widened further this year.

Why does the shortage persist?

• Underbuilding since 2008: After the Great Financial Crisis, builders pulled back, and new construction never fully caught up with population growth.

• Zoning and regulation: Restrictive land-use laws, particularly in major metros, choke supply.

• Labor and material shortages: Higher construction costs and worker shortfalls slow new builds.

• Construction permit decline: From 2020 to 2025, homebuilding permits in the “typical” U.S. metro fell 32%, with a steep drop in multifamily approvals, according to HomeAbroad.

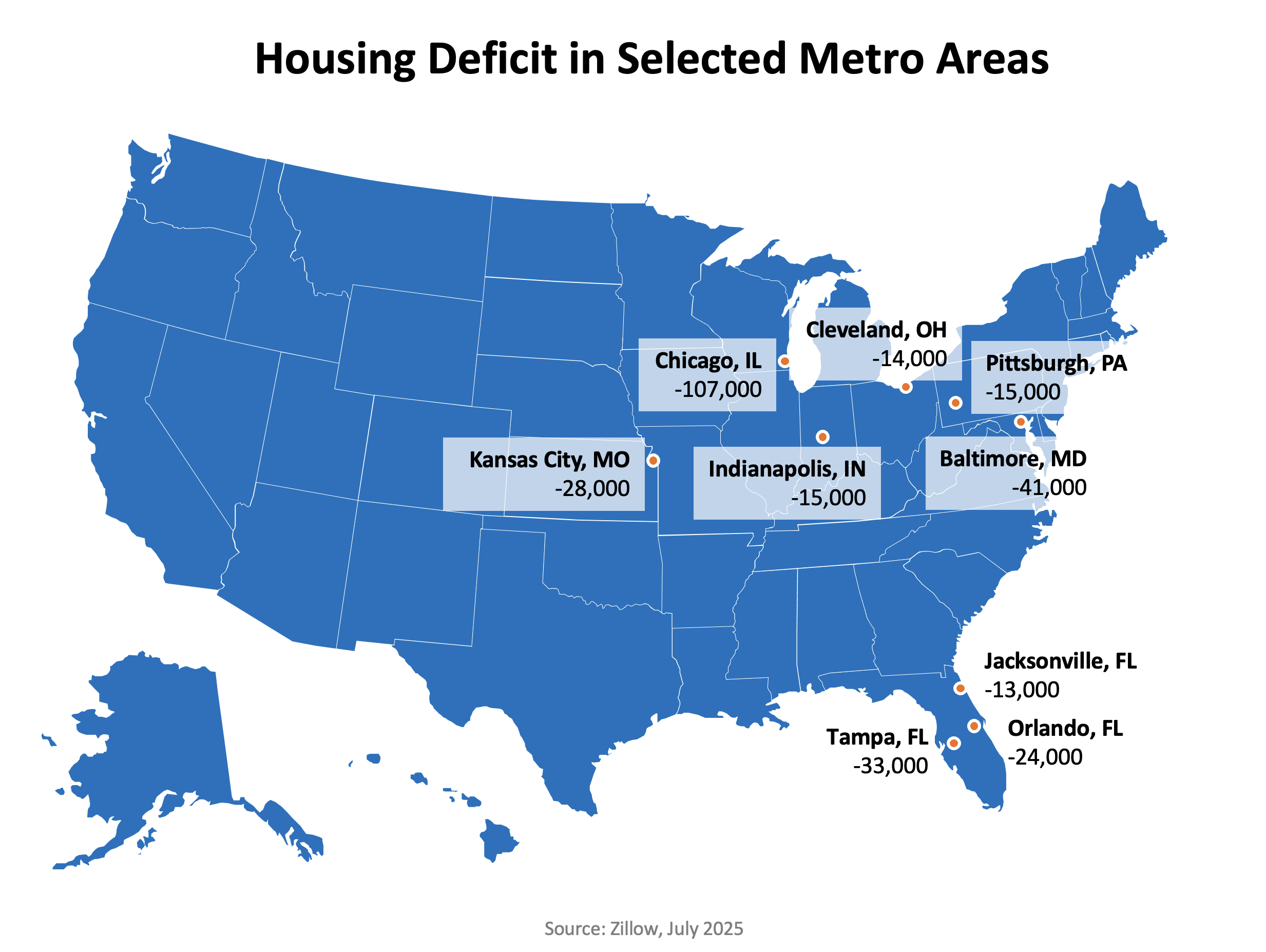

Regional Spotlight: Housing Demand Outpaces Supply Across Safeguard Markets

The housing shortage isn’t confined to the coasts—it’s increasingly visible across America’s heartland, including the key regions where Safeguard’s First Trust Deed portfolio is concentrated.

Zillow’s estimated 4.7 million homes deficit includes shortages deepening even in traditionally stable or affordable metros. Each of the following cities continues to experience tightening supply, steady price appreciation, and robust rental demand—creating a strong foundation for real estate-backed lending.

• Baltimore, MD — Zillow reports a deficit of 41,000 homes, driven by steady job gains and limited new construction.

• Cleveland, OH – Short about 14,000 homes, with tight inventory and modest but consistent price growth.

• Jacksonville, FL – A magnet for in-migration, Jacksonville’s Deficit near 13,000 homes, reflects population inflows and slowed multifamily starts.

• Tampa, FL – Gap of roughly 33,000 homes; active listings remain far below pre-pandemic norms.

• Chicago, IL – Even with slower population growth, Chicago faces a shortage of roughly 107,000 homes, according to Zillow estimates, as construction fails to offset aging housing stock.

• Indianapolis, IN – Approximately 15,000 homes short, according to Zillow, as construction lags migration trends.

• Kansas City, MO – The metro’s deficit remains acute with a gap of 28,000 homes and for-sale inventory significantly below normal. Strong job inflows in transportation and manufacturing sectors are keeping demand firm.

• Pittsburgh, PA – Short roughly 15,000 homes, as aging housing stock constrains supply.

• Orlando, FL – Gap of nearly 24,000 homes, as tourism recovery and population inflows continue to outstrip supply.

Collectively, these metros illustrate a broader truth: even markets once known for balance are now undersupplied. That imbalance sustains housing demand, supports collateral values, and underscores the strength of First Trust Deeds in diverse regions across the country.

Ripple Effects on Main Street

For everyday Americans, the housing shortage isn’t an abstract statistic—it’s reshaping life in tangible ways:

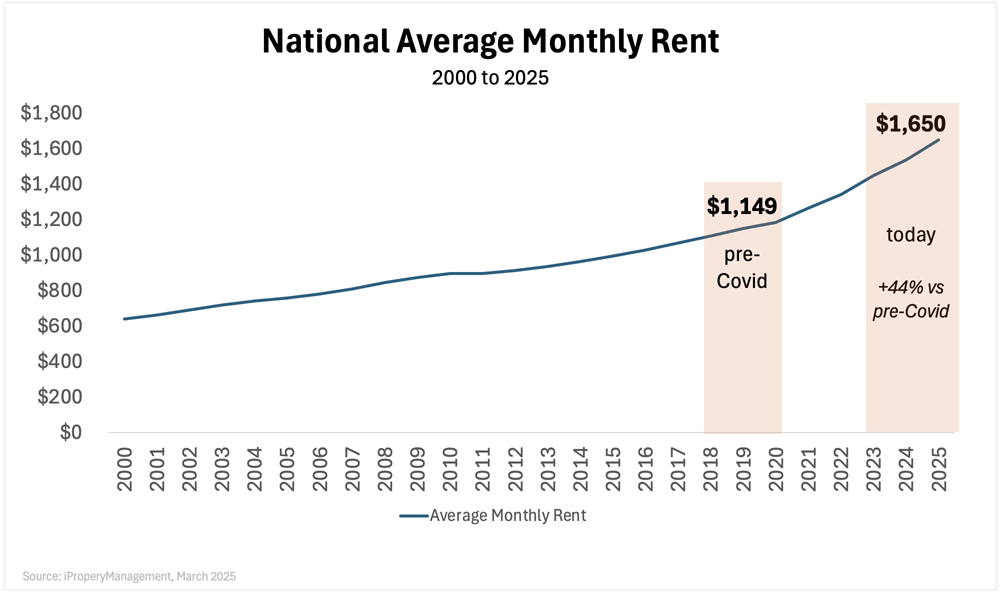

• Rising rents: With national rental vacancy rates hovering at just 7.0%, according to the Census Bureau, landlords maintain pricing power. Rents increased 44% from pre-Covid levels and 7.5% year-over-year, per iPropertyManagement. See the “National Average Monthly Rent” chart for details.

• Delayed homeownership: Millennials and Gen Z households are locked out as prices climb faster than wages, according to the U.S. Chamber of Commerce.

• Local economies under strain: Businesses in tight-supply metros struggle to recruit workers who can’t find affordable housing nearby, according to the U.S. Chamber of Commerce.

Rate cuts may make borrowing cheaper, but they do nothing to ease these structural constraints. As long as supply lags demand, housing affordability will remain an anchor on Main Street families.

Wall Street vs. Main Street: A Familiar Disconnect

Wall Street is celebrating the Fed’s move—stocks rose in September as investors bet on lower rates boosting growth. But the rally ignores Main Street reality.

For families, lower mortgage rates mean little if there’s nothing to buy. Low vacancy rates keep rents climbing. The disconnect is stark: Wall Street thrives on rate speculation, while Main Street grapples with housing scarcity.

What It Means for Investors

For investors seeking stability, the takeaway is clear:

• Persistent demand: Even if rates fall further, the supply shortage guarantees strong demand for housing.

• Strong collateral: Real estate remains a reliable backstop, supported by scarcity.

• Rental strength: With vacancies low, landlords and developers remain motivated to borrow and build.

This environment reinforces the case for First Trust Deeds.

First Trust Deeds: Stable Income in a Shortage Economy

First Trust Deeds provide:

• Stable income: Competitive yields of 10.5%+, far outpacing Treasuries.

• Collateral strength: Backed by real estate in a market where supply shortages support long-term value.

• Inflation protection: Rising rents ensure trust deed income keeps pace with costs.

• Wealth preservation: Shielded from Wall Street’s volatility, grounded in real Main Street demand.

Even as Wall Street rides the Fed’s headlines, real opportunity lies in financing the homes Main Street so desperately needs.

Final Take: The Fed Can’t Build Homes

The Federal Reserve can lower rates. It can cheer markets. But it cannot manufacture houses.

America’s housing shortage is a structural, long-term challenge—and that’s exactly why First Trust Deeds are positioned to thrive. By investing in real property and real borrowers, you gain stability, transparency, and a role in addressing Main Street’s most pressing need.

Safeguard has over 20 years of experience guiding investors through uncertain markets. If you're ready to trade speculation for stability, let’s talk.

Call us today at 877-280-5771 to learn more.

Because the only thing riskier than moving with the herd—is not moving at all.