Booming Housing Market July 2021

In today’s newsletter we want to review the booming housing market in the United States, the evolution of the unemployment rate and the latest inflation data to provide you with a status update on our economy and to point out an excellent investment opportunity.

U.S. Housing Market

The U.S. national housing market has been on the up-and-up for the 11th straight month. In April 2021, the Case-Shiller index showed an annual gain of 14.6%, which marks the fastest growth in the 34-year history of the index. See chart “S&P Case-Shiller U.S. National Home Price Index” for details.

April’s performance was truly extraordinary, because housing prices in all 20 U.S. major metropolitans rose. Five cities - Charlotte, NC, Cleveland, Dallas, Denver and Seattle saw their largest gains ever. Source “S&P Case-Shiller 20-City Composite Home Price Index, June 2020.”

What is more, the U.S. national housing market has proven to be stable and quite resilient during recent recessionary periods, including the covid-19 pandemic. Except for the financial crisis in 2008, the housing market has not shown significant downward corrections during the early 1990s recession, the dot-com bubble, and the most recent covid-19 pandemic.

Reason for the Housing Boom

The current strength of the U.S. housing market is being driven by reaction to the covid-19 pandemic, as potential home buyers chose to trade their urban apartments for suburban homes.

Buyer demand has continuously outstripped supply, leading to price gains over the past 11 months. Prior to the covid-19 pandemic, the U.S. housing market offered more than 6 month’s supply. Once the pandemic began to affect the U.S., the supply began to drop sharply, bottoming out at a level of 3.5 month’s supply. In early 2021, supply levels have gradually increased to a level just above 4 month’s supply, which is still well below pre-covid supply levels and indicates that demand remains high. See chart “Monthly Supply of Houses in the United States” for details.

For our clients, the ongoing currently low levels of housing supply offers a good opportunity to still make an investment in the housing market.

Unemployment Rate

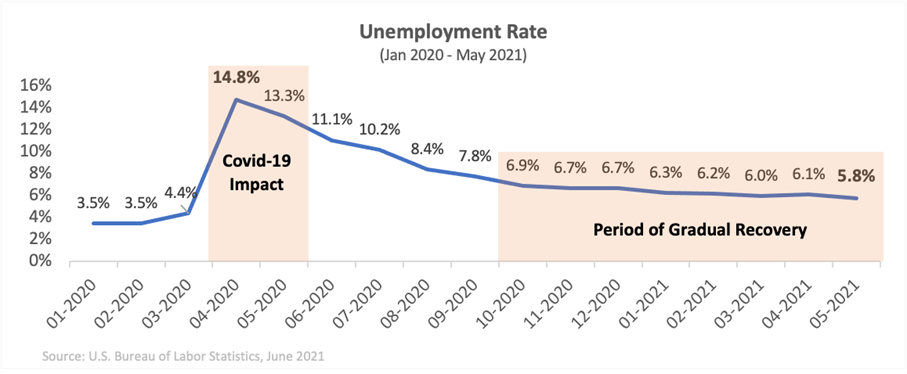

Once covid-19 began to impact the U.S. economy in April 2020, the unemployment rate immediately shot up to 14.8%. Since then, the U.S. labor market has posted gains month after month, first strong and then more gradual. Since October 2020 gains have been more gradual, eventually leading to an unemployment rate of 5.8% in May 2021. See chart “Unemployment Rate” for details.

In May of 2020, the U.S. Bureau of Labor Statistics began tracking the number of persons who were unable to work due to the pandemic. When the number was first recorded, 49.8 million people were affected. This number also come down significantly. In April 2021 it was at 9.4 million and in May 2021 it dropped to 7.9 million, its lowest level yet. Source “U.S. Bureau of Labor Statistics, June 2020.”

While the news from the labor market is good, there is still room for improvement. Pre-pandemic levels were around 3.5%, whereas the current level is at 5.8%. Policy makers are working on reducing that number further in the coming months. So, we should expect more people joining the labor force and we should see more potential home buyers.

Inflation

In our last newsletter, you saw that the overall inflation rate of 4.6% in April 2021 was the highest year-over-year increase since the financial crisis of 2008. This record has now been broken. In May 2021 the inflation rate reached 5.0% year-over year. The main driver were used cars & trucks (+29.7%), followed by energy (+28.5%). Shelter, which represents the price of purchasing or renting a home, increased by 2.2% versus one year ago. In April the inflation for shelter was 2.1%. Source “U.S. Bureau of Labor Statistics, June 2020.”

These high levels of inflation are likely to continue for the remainder of 2021, causing the prices of most goods, including housing, to increase further. This is giving you a good reason to act now to protect your cash.

Recommended Action

A high demand for housing paired with limited supply, good news from the labor market and on-going inflation are three positive indicators why you should invest in the housing market now. If you are looking for ways to safeguard your cash from inflation and earn a return, you should act now.

We would like to offer you an easy way to invest in real estate while earning a return above the rate of inflation, so you can benefit from the housing boom. Real estate lending offers you attractive interest rates, backed by the security of the underlying property.

If you are interested in protecting your purchasing power and growing your overall wealth through real estate lending, we encourage you to contact our representatives to learn more about First Deed Lending.